- Content

Cyprus has been one of the most attractive jurisdictions for tax residency for many years. The advantages of the island’s tax system are combined with its favorable geographical location, membership in the European Union and mild climate. For businesses and individuals, tax residency in Cyprus can open the door to significant financial and legal opportunities. Let’s take a look at the key advantages of tax residency in Cyprus, supported by specifics and statistics.

1. Low tax rates

One of the main factors attracting foreigners to Cyprus is the low corporate tax rate of only 12.5%, which makes Cyprus one of the most favorable jurisdictions in Europe. According to Eurostat, the average corporate tax rate across the EU is 22%, which is almost twice as high as in Cyprus. This favorable condition encourages the opening of companies on the island and its use as a base for international operations.

2. Tax benefits for individuals

For individuals, tax residency in Cyprus also offers significant advantages:

- No capital gains tax (except for capital gains related to real estate in Cyprus), which is a strong argument for investors.

- No inheritance tax, which makes Cyprus favorable for family capital planning and intergenerational transfer of property.

- Exemption from taxation of foreign dividends for individuals who can prove their tax residency.

In addition, there is a “Tax Residency for 60 Days” program, which allows a person to become a tax resident of Cyprus if he/she spends only 60 days a year on the island and fulfills a number of conditions (no tax residency in other countries, presence of activity in Cyprus). This is particularly attractive for international entrepreneurs who do business in several countries.

3. No taxation on dividends and interest

Dividends received from companies are tax-free for 17 years (see Non-Domicile status below). Interest earned on deposits or other financial instruments is also exempt from taxation. This makes Cyprus attractive to investors looking for long-term capital growth opportunities.

4. A wide network of double taxation treaties

Cyprus has concluded more than 65 international double tax treaties, which guarantees protection against double taxation of income and capital in two jurisdictions. This is particularly relevant for international business owners who are interested in minimizing the risks of double taxation.

5. Non-Dom Program: income tax exemption

The Non-Domiciled Status (Non-Dom) program allows new tax residents of Cyprus to be exempt from tax on dividends, interest and capital gains derived from foreign sources for a period of 17 years. This offer has attracted a significant number of high net worth individuals and investors wishing to protect their assets and minimize their tax liabilities.

6. Stable and transparent tax system

The Cypriot tax system is characterized by its stability and transparency. On the one hand, it complies with the standards of the European Union and international organizations such as the Organization for Economic Cooperation and Development (OECD), which makes it predictable and protects it from unexpected changes. On the other hand, the Cypriot government actively supports investment, creating a favorable environment for businesses and international investors.

7. Attractive conditions for pensioners

Cyprus also offers special benefits for pensioners. For example, pensioners can choose between a flat tax rate of 5% on pensions coming from abroad or the standard income tax scale. This makes Cyprus a popular destination for retirees looking for a favorable living environment and preservation of their savings.

8. Economic growth and stable financial climate

The Cypriot economy is showing steady growth. In 2023, GDP growth amounted to 3.5%, which confirms a positive economic climate and open business opportunities. The country is actively developing the IT, financial services, tourism and real estate sectors, which creates additional incentives for residents and investors.

There are also a number of additional factors that contribute to the choice of the island as a place for tax residency. Let us consider other aspects that make Cyprus a particularly favorable jurisdiction for residence and business.

1. Flexibility in tax planning

Cyprus offers tax residents a high level of flexibility in personal and corporate tax planning. For individuals, this means that it is possible to optimize personal income through the use of various tools and strategies such as income distribution, the use of international trusts and foundations. Cyprus trusts, for example, are not subject to taxation if the trust assets are located outside Cyprus and the beneficiaries are not tax residents of Cyprus.

2. Tax incentives for new companies and startups

Cyprus actively supports new companies and start-ups by offering tax breaks and incentive programs. Companies registered in the innovation sector can obtain additional tax exemptions, especially in the field of research and development (R&D). In particular, Cypriot law provides an 80% exemption on profits from the use of intellectual property rights (IP Box regime), which attracts start-ups in the field of high technology and R&D.

3. Ease of registration and doing business

One of the key factors that make Cyprus attractive to companies is the ease of registering and doing business. The company registration process takes only a few days and does not require the physical presence of the founders in Cyprus. In addition, reporting and corporate governance requirements are minimal compared to other EU jurisdictions. Companies can also utilize the services of nominee directors and shareholders for additional privacy.

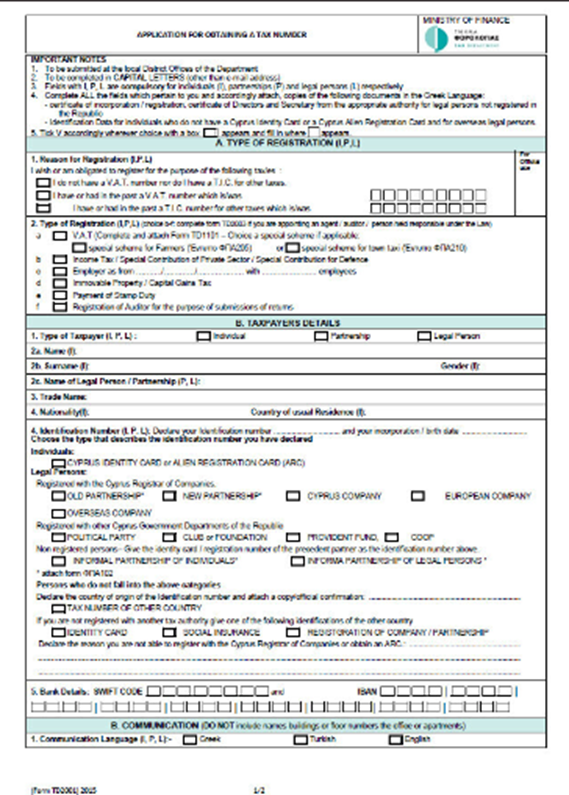

4. Simple procedure for obtaining tax residency

The procedure for obtaining tax residency in Cyprus is quite transparent and simple. As mentioned earlier, the “Tax Residency for 60 Days” program provides an opportunity to obtain the residency status with minimum requirements. It is important to note that for the majority of residents applying for the status under this program, there is no mandatory purchase of real estate on the island, which reduces the cost of relocation.

5. Low administrative costs

Налоговые резиденты на Кипре также пользуются преимуществами низких административных издержек. Государственные сборы и тарифы за регистрационные действия, оформление лицензий и подачу отчетности значительно ниже, чем в других странах ЕС. Это означает, что как для физических лиц, так и для компаний расходы на соответствие местным требованиям минимальны, что делает управление бизнесом или личными активами экономически выгодным.

6. Privacy and data protection

Cyprus has strict laws protecting the personal data and privacy of taxpayers. The country has implemented modern privacy and data protection standards that are compliant with the European Union (GDPR). This gives confidence to residents and investors that their personal information and financial data is protected.

7. Ideal location for international investors

Cyprus is a favorable platform for international investors who want to use it as a hub for investments in Europe, Asia and Africa. With its EU membership and convenient international agreements, Cyprus provides access to major markets, and investment in Cyprus gives access to the benefits available in countries with signed double tax treaties.

8. Residency through investment program

Tax residents in Cyprus can also take advantage of the possibility of obtaining a Cyprus residence permit through investment programs. The program offers a pathway to immigration residency through investments in real estate, government bonds or local businesses. Obtaining Cypriot residency provides full access to all the benefits of living on the island.

9. High quality of life and developed infrastructure

Moving to Cyprus is not only associated with financial benefits, but also with a high quality of life. The island is known for its clean beaches, favorable climate and developed infrastructure. A well-developed network of international schools, medical facilities and a safe environment make Cyprus an ideal destination for families and professionals who seek to combine comfortable living with a favorable tax climate.

Conclusion

Tax residency in Cyprus offers many opportunities for tax optimization, income growth and asset protection. The favorable business environment, the absence of tax on dividends and interest, and the wide network of double taxation treaties make Cyprus attractive to international entrepreneurs and investors. The stable economic situation and the support of the government ensure that Cyprus will remain one of the leading jurisdictions for tax residency in the future.

Almanova Law specialists have in-depth knowledge and many years of experience in tax residency in Cyprus. We will help you not only to appreciate the advantages of the Cypriot tax system, but also guide you through all stages of obtaining residency – from preparation of necessary documents to optimization of tax planning. If you contact us, you will receive a personalized approach and comprehensive advice on all aspects of doing business and asset management in Cyprus, which will allow you to take advantage of all the opportunities offered by this advantageous jurisdiction.

Almanova Law specialists will help you not only to evaluate the advantages of the Cypriot tax system, but also guide you through all the stages of obtaining residency