- Content

Capital Gains Tax (CGT) in Cyprus is a key element of the tax system governing the taxation of gains from the sale of certain types of property. Unlike many European countries, Cyprus has a special CGT structure, providing taxpayers with significant advantages, including exemption from taxation of certain types of assets and special treatment for non-residents.

Legislative framework and features of CGT in Cyprus

The regulation of capital gains tax in Cyprus is based on the Capital Gains Tax Law, which defines tax rates, types of taxable property and exemptions. Unlike corporate income tax or personal income tax, CGT applies only to certain types of assets, making it a specific tax instrument.

In Cyprus, capital gains tax is not levied on the sale of shares, bonds and other financial instruments. This makes the jurisdiction attractive to investment funds and private investors engaged in stock market transactions. However, CGT applies to real estate located in Cyprus, as well as to shares of companies if more than 50% of their value is linked to Cypriot real estate.

Capital Gains Tax (CGT) rate and calculation procedure in Cyprus

1. General CGT rate and its application

In Cyprus, the standard rate of capital gains tax (CGT) is 20%. This rate applies only to certain types of property, the sale of which gives rise to taxable capital gains.

CGT does not apply to income from the sale of most financial assets such as:

- Shares, bonds and other securities;

- Equity instruments in investment funds;

- Cryptocurrency (at the moment, in accordance with Cyprus tax regulation practice).

However, tax is imposed on capital gains realized from the sale of:

- Real estate located in Cyprus;

- Shares in companies if more than 50% of the company’s assets are real estate located in Cyprus.

The application of CGT is possible for both individuals and legal entities if they sell real estate or shares in companies, a significant part of the value of which is attributable to real estate.

2. CGT calculation formula

CGT is levied on net capital gains, which is calculated as the difference between the sale price and the adjusted acquisition cost subject to indexation and allowable deductions.

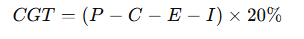

CGT Calculation Formula:

Where:

- P (Price) — the selling price of the real estate;

- C (Cost) — purchase price of real estate;

- E (Expenses) — costs associated with the improvement of the object (major repairs, reconstruction);

- I (Inflation adjustment) — inflation adjustment.

Example of CGT calculation

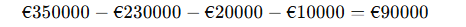

Suppose an investor purchased a property in Limassol for €200,000 in 2010 and sold it for €350,000 in 2024.

Additional expenses:

- Property improvement costs (major repairs) — €20 000;

- Notary, real estate agent and lawyer costs — €10 000.

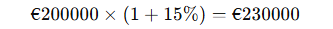

Inflation adjustment: the indexed purchase price, taking into account an inflation rate of 15% over 14 years, will be €230,000.

Now we calculate the tax:

- Net capital gains

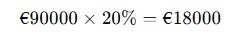

- CGT at a rate of 20%:

Total: tax payable will be €18 000.

3. Indexation of the value of assets

An inflationary adjustment is applied to calculate the taxable base. The Cypriot tax authorities use the Consumer Price Index (CPI) to adjust the purchase price to reduce the tax burden.

Example: if a property is purchased for €200,000 in 2010 and the CPI has increased by 15% over this period, the adjusted purchase price would be:

This lowers the taxable base and reduces the CGT.

4. Allowable tax deductions

The following expenses are deductible to reduce CGT:

- Property improvement costs – if the owner has invested in major renovations, these expenses are deductible from the taxable gain.

- Transaction costs – real estate agent commissions, notary and legal fees.

- Financing costs – if the sale is related to the repayment of a mortgage loan, a portion of the interest costs may be deductible.

5. CGT benefits and exemptions

Certain transactions are exempt from CGT, allowing taxpayers to legally minimize their tax burden:

5.1. Sale of principal residence

If the property has been used as the owner’s main residence for at least 5 years, an exemption of up to €85,430 applies.

Example:

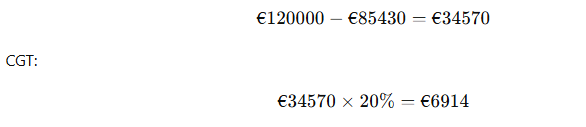

A Cypriot national sells a house in which he has lived for 6 years with a capital gain of €120,000. The exempt amount is €85,430, taxable CGT base:

So instead of paying €24,000, the owner will only pay €6,914.

5.2. Inheritance and gifting

CGT is not charged on the transfer of real estate by inheritance or gift between family members. This makes Cyprus a favorable destination for inheritance planning.

5.3. Sales between relatives

Transactions between spouses, parents and children, brothers and sisters are exempt from CGT.

5.4. Sales of agricultural land

If the property was used in farming activities, capital gains up to €25,629 are exempt from CGT.

5.5. Sale under forced alienation

If real estate is sold to the government (e.g., for road construction), the transaction is not subject to CGT.

6. Comparison of the CGT of Cyprus with other countries

In Europe, CGT varies:

- UK – 10-28% depending on the taxpayer’s income.

- France – 36.2%, including social taxes.

- Germany – 25% if the property is sold within 10 years of purchase.

- Spain – 19-26% depending on the amount of capital gains.

- Cyprus – fixed rate of 20%, but with a number of benefits.

Thus, Cyprus remains one of the most favorable jurisdictions for investors, especially in terms of long-term investments in real estate.

Current CGT taxation practices

In recent years, the Cyprus tax authorities have intensified their scrutiny of real estate transactions. Tax minimization schemes through nominee companies are particularly scrutinized.

Case in point:

A company owning commercial real estate sold it through a chain of offshore structures. The Cyprus tax authorities proved that 50% of the company’s assets were related to real estate, which resulted in additional CGT.

Exemptions and tax exemptions

Cypriot law provides for a number of exemptions and deductions that reduce the tax burden:

- Sale of main residence – if the property has been used as the owner’s main residence for at least 5 years, capital gains of up to €85,430 are exempt from CGT.

- Sale of agricultural land – the exemption applies to farmers who are engaged in agriculture and sell land used in farming activities.

- Inheritance and gift – the transfer of property by inheritance or gift is not subject to CGT, making Cyprus attractive for inheritance planning.

- Sale of property between relatives – transactions between parents and children, spouses or siblings are also exempt from CGT.

Comparative analysis with other countries

Cyprus offers one of the most favorable capital gains tax systems in Europe. For example, in the UK the CGT rate varies from 10% to 28% depending on the type of assets and the level of income of the taxpayer. In France, capital gains tax can be as high as 36.2%, including social contributions. In Germany, CGT is 25%, but only applies to the sale of real estate if it has been owned for less than 10 years.

Practice of CGT application in Cyprus

In actual practice, the Cyprus tax authorities closely monitor the application of CGT, especially in real estate transactions. It is common practice to use nominee shareholders or holding structures to minimize taxes. However, the tax authorities have increased their scrutiny of such schemes and in recent years there have been several audits of large transactions.

Case in point: a Cypriot company that owned commercial real estate sold the property through an offshore company structure. The tax authorities found that more than 50% of the company’s assets were real estate related, resulting in CGT taxation in Cyprus despite the use of an international structure.

Statistics and the impact of CGT on the market

According to the Cypriot Ministry of Finance, capital gains tax receipts in 2023 amounted to around €280 million, an increase of 18% compared to 2022. The increase is attributed to the revitalization of the real estate market, especially in Limassol and Nicosia. In recent years, Cyprus has become a key destination for foreign investors, especially from Russia, China and Israel.

In 2023, more than 14,000 real estate transactions were registered in Cyprus and the total value of transactions exceeded €6 billion. The largest growth was seen in the premium real estate segment, due to the active interest of investors seeking to take advantage of the country’s tax system.

Cyprus remains an attractive jurisdiction for investors due to its flexible capital gains tax system. The CGT exemption for securities makes the country attractive to stock investors, while the real estate tax incentives create favorable conditions for long-term investments. However, increasing scrutiny by the tax authorities requires careful attention to the structure of transactions, especially in the corporate real estate segment.

The future of capital gains tax in Cyprus may change depending on the economic situation and pressure from the EU. Adjustments to the rates and revision of the list of exemptions are possible, which may affect the attractiveness of the country for international investors.

Capital gains tax on the sale of real estate in Cyprus