- Content

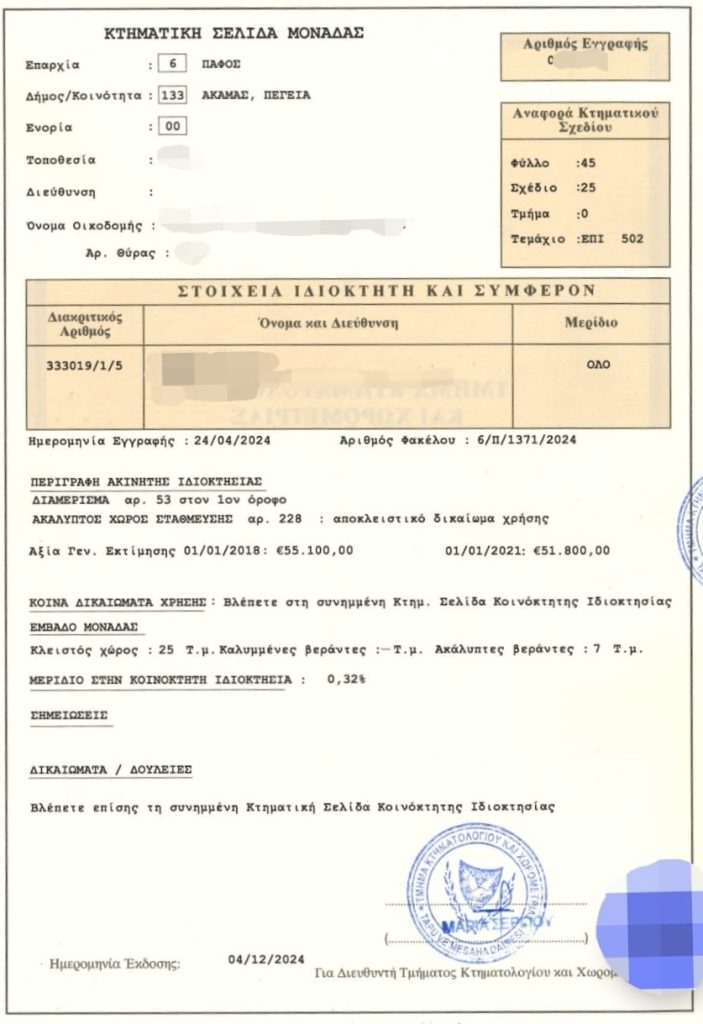

A Cyprus Title Deed, also referred to as a Title Deed, Kochani, Title List or simply Title Deeds, is a document that confirms the ownership of a particular property. It provides legal protection to the owner and allows for the free disposal of the property, including selling, inheriting, leasing or mortgaging it. This document is the main proof of ownership and is established on the basis of the Cyprus Real Estate legislation.

A title deed is also known as a title deed or certificate of ownership. Titles are issued by the Cyprus Department of Lands and Surveys (Department of Lands and Surveys), which is the governmental body that regulates the ownership of real estate in the country..

What is a real estate title deed?

A property title deed in Cyprus is a government document which states:

- The name of the owner/s of the property and the ownership shares.

- Address and description of the property (plot of land, house, apartment, etc.).

- Date of issuance.

- Legal encumbrance (if any).

- The area of the object and its location linked to the cadastral map.

A title deed means that the owner has been granted full ownership of the property. This document is essential to confirm the legality of ownership of a property in Cyprus and is considered legally important in any real estate transaction. Please see below for notes on situations in which a property is purchased without a Title*.

Why do you need a title? A title is a mandatory document in any legal real estate transaction:

- Buying or selling real estate. Having a title allows you to conduct a full-fledged transaction, as it guarantees the absence of any violations related to construction.

- Transfer by inheritance. If the owner of the property has a title, the process of transferring the property by inheritance becomes easier.

- Mortgage and lending. Banks require a title to grant a mortgage or loan against the property (in cases of secondary market).

- Involvement in litigation. Title serves as the primary proof of ownership when disputes arise.

Criteria for obtaining a real estate title in Cyprus

The process of obtaining title can vary depending on the type of property, the developer’s situation, and the status of the property at the time of purchase. Here are the basic criteria that must be met to obtain a title:

- Purchase of completed real estate

- If a buyer purchases a property that has already been titled (secondary housing), he or she can immediately apply for the title to be transferred in his or her own name. In this case, a standard set of documents and confirmation of the transaction at the Land Registry Department are required.

- Purchase of real estate at the construction stage

- In the case of buying a property at the construction stage, the title may not be immediately available to the buyer. The developer must go through a number of processing steps, including obtaining a building permit and a completion certificate (certificate of final compliance). Only after these steps have been completed can title release be requested.

- The buyer can enter into a sales contract with the developer and register it with the land department, which will provide legal protection. However, the title will only be issued after the completion certificate has been obtained and a separate Title has been issued for the property to be purchased.

- Registration of the Sale and Purchase Agreement

- Once a sale and purchase agreement has been concluded, the purchaser is required to register it with the Land Registry Department. This is a legal requirement and registration of the contract protects the buyer by preventing the developer from selling the property to another person or pledging it as collateral.

- Once the registration of the sales contract is complete, the buyer is protected from selling the property to third parties and can request a title deed.

- Repayment of all taxes and fees

- Before title is issued, full payment of taxes and fees associated with the property is required, including:

- Value Added Tax (VAT) if the property was purchased from a developer.

- Capital Gains Tax – paid by the seller when the property is sold.

- Municipal taxes and levies – to confirm that there are no debts owed to local authorities on the property.

- Before title is issued, full payment of taxes and fees associated with the property is required, including:

- Mortgage verification and registration

- If the property is purchased using a mortgage loan, the mortgage must be registered with the Land Registry. Once all mortgage payments have been completed, it is possible to request that the encumbrance be lifted and the title to the property be transferred to the buyer’s name without restriction.

Cost of title reissuance

The cost of transferring the title to the new owner includes a Transfer Fee, which is calculated according to the value of the property. This tax is the main cost of the title transfer.

- Transfer Fee (Transfer Tax)

- The Transfer Fee rate varies depending on the amount of the transaction and is:

- 3% on the first €85,000 of the property value.

- 5% for the amount between €85,000 and €170,000.

- 8% on the amount over €170,000.

- For example, if the property is worth €300,000, the tax calculation would be as follows:

- 3% of the first €85,000 = €2,550

- 5% of the next €85,000 = €4,250

- 8% of the remaining €130,000 = €10,400.

- The total Transfer Fee will be €17,200*

- The Transfer Fee rate varies depending on the amount of the transaction and is:

Right now there is a 50% discount for the Title Reissue Fee. We have a Calculator on our website to calculate the costs of a real estate transaction, including the Title Reissue Fee.

- Discounts on Transfer Fee

- If the property was subject to VAT at the time of purchase, the buyer may be granted a Transfer Fee exemption.

- This condition applies to buyers who purchased a new home from the developer and paid VAT, which makes the purchase of real estate more profitable.

- Additional costs

- In addition to the Transfer Fee, other costs may be incurred, such as the services of a solicitor to represent the buyer. The cost of legal services varies and can range from 1% of the value of the property, depending on the complexity of the transaction and the services provided by the lawyer.

Stages of obtaining a real estate title in Cyprus

1. Conclusion of a sale and purchase agreement

The first step toward obtaining title is to enter into a purchase and sale agreement between the seller and buyer. At this stage it is important to:

- Conduct a full due diligence of the property. This is usually done by the buyer’s attorney. Due diligence includes:

- Establishing the legal owner of the property.

- Checking that there are no legal encumbrances or debts that could affect the buyer’s rights.

- Establishing the rights to the land plot, if it is the purchase of a house or villa.

- Conclude a preliminary contract (reservation agreement). In practice, the parties may sign a preliminary agreement to fix the terms of the transaction and prevent the possibility of selling the property to third parties while the main contract is being prepared. The reservation period in practice is 30 days.

- Agree the terms of the main transaction. The main sale and purchase agreement contains all legal and financial terms, rights and obligations of the parties, description of the object, price and settlement procedure.

2. Registration of the sale and purchase agreement with the Land Cadastre Department

Once the sale contract has been concluded, it must be registered with the Cyprus Land Registry Department. This is a mandatory procedure that protects the rights of the buyer and prevents the possibility of resale of the property or its pledge by the seller.

- The procedure for registering an agreement includes submitting the agreement together with a package of documents to the Land Cadastre Department.

- Documents for registration include:

- A signed contract of sale and purchase.

- A copy of the buyer’s passport and his immigration document.

- Confirmation of payment of part of the cost of the property (most often the down payment).

- Payment of stamp duty.

- The result of registration: the registered contract confirms that the buyer has secured his rights to the property and excludes the possibility for the seller to enter into transactions with third parties. This contract is kept in the cadastre until the title deed is issued and is the basis for further title deeds.

3. Meeting building requirements and obtaining certificates (if the property is new)

If the property is being purchased during the construction phase or is a new build, all building requirements must be met by the developer. This is a key stage, as the property cannot be titled without completing all mandatory works and obtaining the necessary certificates.

- The building completion certificate is one of the most important documents confirming that the building has been constructed in accordance with all building norms and standards. It is obtained by the developer after the completion of all construction works and then provides this certificate to the Land Registry.

- Important: The Purchase Agreement stipulates the Builder’s obligation to obtain the Certificate of Final Compliance within a specific period of time and also leaves a small balance for payment, only after receiving this certificate.

- Issuance of permits and approvals: The developer must obtain final permits and approvals from the municipality and building authorities, which confirm that the facility meets the standards and is ready for use.

- Inspection of utilities and engineering facilities: In the case of an apartment building, all utilities, including water, sewer, and electricity, must be inspected and approved. These inspections confirm that the infrastructure meets standards and can be used by the tenants.

4. Verification and payment of taxes and levies

The buyer is obliged to pay all taxes and fees related to the property before the title is issued. Cyprus law provides for a number of mandatory payments:

- Transfer Fee (Transfer Fee): This is the main tax that is paid when a title is issued. The rate of Transfer Fee depends on the value of the property (as discussed above). This tax is paid once and is mandatory to complete the transaction.

- Value Added Tax (VAT): In the case of a purchase from a developer, the buyer may be liable to pay VAT, which is normally 19%. VAT may be reduced to 5% for persons purchasing a property for permanent residence, subject to certain conditions.

- Municipal Taxes and Fees: Before issuing a title, it is important to make sure that the property does not owe any debts to municipal authorities, including property taxes, garbage collection fees, and other municipal fees. These taxes are usually small, but debts can be a barrier to title.

5. Filing an application for a title with the Land Cadastre Department

Once all the previous steps have been completed, the buyer can apply for a title deed in his or her name. This is a key stage during which all documents and the buyer’s rights are verified by the Land Registry Department.

- Application Procedure:

- Submitting an application to the Land Registry with all supporting documents, including the sales contract, tax receipts and certificate of completion.

- Verification of all data submitted by the applicant and seller, and verification that all terms of the transaction have been fulfilled.

- The application processing time may vary depending on the workload of the land registry and the specifics of the property (new construction, resale, etc.). The process usually takes 1-2 months.

6. Issuance of real estate title

Once all documents are verified and confirmed, the Land Registry Department issues a title deed in the name of the buyer. This is the final stage, which formally completes the ownership process.

- The final title is issued to the buyer and is full proof of ownership of the property.

- Fee: The final title fee includes Transfer Fee and other related costs, depending on the type and value of the property.

Important!

The Cyprus Title gives the owner full control over the property, allows the owner to dispose of it freely (sell, rent, inherit, etc.) and is the key document confirming ownership. It is also possible to make structural changes and renovate your property after obtaining the Title Deed.

Examples of situations depending on the type of facility

- Example 1: Purchase of a secondary dwelling. The buyer enters into a contract with the seller, registers it with the cadastre and immediately applies for title as the property does not require a completion certificate.

- Example 2: Buying an apartment under construction. The buyer enters into a contract with the developer, registers it and waits for the construction to be completed. Once the builder receives the completion certificate from the developer, the buyer can apply for title.

- Example 3: Buying an apartment / house that is about 4 years old and does not have a Title. Need to do a detailed check on the reason and in case the svldelay is due to adequate reasons, move forward with the transaction.

Legal aid

Specialists of Almanova Law will assist you in titling a property in Cyprus, providing full support at all stages of the process. The team of professionals will undertake the legal due diligence of the property, registration of the sale and purchase agreement, fulfillment of all requirements and payment of mandatory fees, as well as submission of documents to the Land Registry Department. The company’s specialists will help to comply with all legal requirements and minimize risks, ensuring the safest and most comfortable registration of your ownership of real estate in Cyprus.

Specialists of Almanova Law will assist you in titling property in Cyprus, providing full support at all stages of the process.